Ahead of the Spring Statement, I called on the Government to reverse the planned National Insurance hike. Research from the New Economics Foundation found that since the last election, disposable incomes have fallen by £110 for the poorest 50% and risen by £3,300 for the richest 5%. The National Insurance Hike is yet another regressive tax which will disproportionately hit the finances of all but the very richest households. A Government that cared about spreading the burden of the economic pain we are now feeling would be drawing up proposals for a wealth tax. But not this party of the rich.

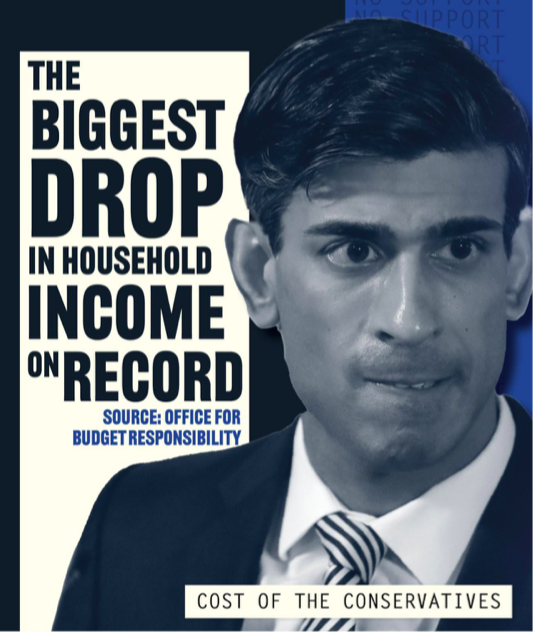

I also reiterated the call for a windfall tax on the excess profits of energy companies benefitting from the price hikes that are immiserating everyone else and for significant boosts to public sector pay, minimum wage, benefits and pensions, that keep pace with inflation as an absolute bare minimum. I wasn’t holding my breath for any of this but even so, the Government completely failed to offer support that matches the scale of the crisis we are now facing. The headline is that we are on course for the biggest decline in living standards in living memory.

Government tax breaks will mostly benefit the wealthier half of society. Increasing NIC thresholds offers some help to those earning £9-£12.5k but the main beneficiaries are those earning £45k+ who will see back over £3k. According to IPPR analysis, the Spring Statement amounts to an average of just £120 in extra support for the poorest 20% of households, while the richest 20% gain an average of £480.

It cannot be stated often enough that real terms cuts to public sector pay, pensions and benefits will leave millions of people – key workers among them – confronting a cost of living crisis with even less money in their pockets. People on benefits could see living costs rise by 10% over the next financial year. Benefits are rising just 3.1%. Also buried in the small print of the Chancellor’s announcement was the fact that tax cuts announced will largely be shouldered by students as a result of Government changes on student loan repayments.

A £330 saving for the average earner doesn’t come close to making up for the likely energy bill increases facing the average household by October this year, let alone the fact that pay is failing to keep pace with inflation. Cutting fuel duty isn’t about helping individual motorists either. A 5p cut means putting petrol prices are where they were just weeks ago. It’s just an excuse for the Government to look like they’re doing something instead of taxing the companies making record profits from sky high energy prices.

It’s hard to find words that do justice to the inadequacy of this month’s Spring Statement, which is condemning millions more households to suffer poverty. Nevertheless, the richest MP in Parliament, who just so happens be the Chancellor of the Exchequer, did send several very clear messages. Firstly, if you’re already struggling to make ends meet, you’re now on your own. Secondly, protecting profits is more important than protecting people. Finally like the last ten years, those with the narrowest shoulders will bear the biggest burden.