I voted against the Government’s Finance Bill, the legislation designed to implement their 2021 Budget, which will only add to the crises of low pay, insecure work, rising poverty and inequality now facing us after ten years of austerity – not to mention Brexit and their shocking handling of the pandemic.

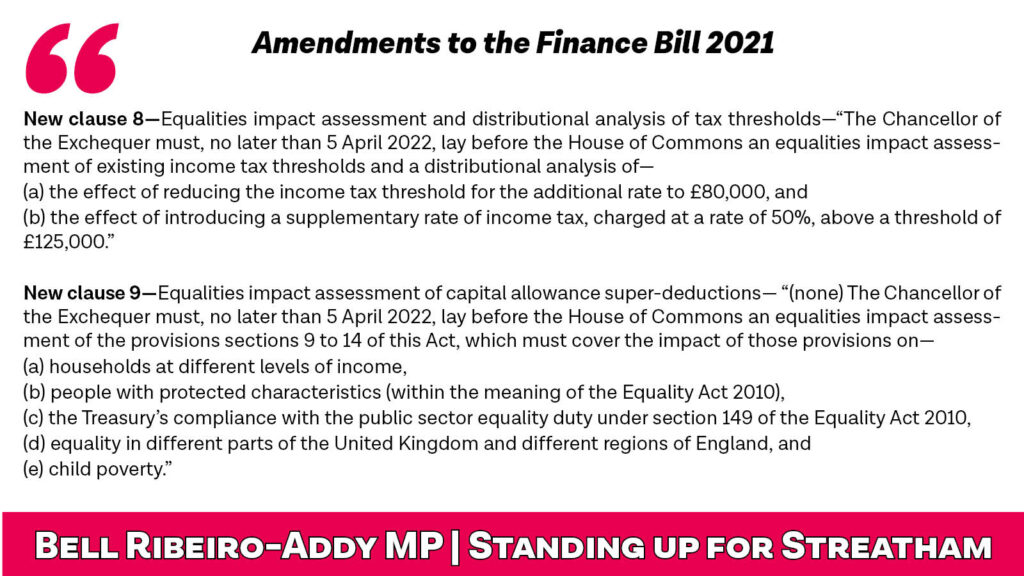

At its third reading, I put down amendments to force the Government to publish an equalities impact assessment of their budget, something they have consistently refused to do. What have they got to hide? MPs should be able to properly scrutinise Government policy decisions with an eye on their potential impacts. We can’t talk about sexism, racism, ableism and poverty properly without talking about the economy.

Incentives such as the super deduction are biggest for large firms and the Financial Secretary to the Treasury has admitted that only 1% of firms will benefit this year, as the rest are within the annual investment allowance. There is no justification for treating the rich and big businesses to mouth-watering tax giveaways and reliefs, despite unclear evidence about whether this will actually create the investment needed.

The pandemic has pried open the wounds of austerity, which never truly healed. This is one explanation behind the Government’s relentless recourse to dog-whistle politics and attempts to divide white working-class communities and ethnic minority working-class communities. These age-old divide and rule tactics will not paper over the shocking inequalities that have grown on their watch and deepened during the pandemic.

Budget 2021 was a missed opportunity to launch a green, equitable recovery that puts people on a secure footing and address the UK’s debilitating inequalities.